Dynasty Trust

The term “dynasty trust” describes trusts designed to last more than one generation beyond the grantor. Properly structured, a dynasty trust removes wealth from the transfer tax system altogether, free to appreciate over generations, with no gift and estate tax, as long as the trust remains in existence and to the degree that state law allows.1

To understand the dynasty trust, you must understand a tax known as the generation-skipping transfer tax (GST). The GST is imposed on transfers to grandchildren and other descendants further down the family line, ergo the name. It is levied on top of gift and estate taxes. The tax was first imposed in 1976, and overhauled to its current form, in 1986, in an effort to mitigate the phenomenon of perpetual, dynastic family wealth. As with the gift and estate tax, the IRS allows an exemption ($11.58 million per individual, $23.16 million per couple as of 2020) before the tax is applied. Aside from that one-time assessment, subsequent generational transfers occur with no tax whatsoever, again, provided that the trust is properly designed and subject to the various state limitations.

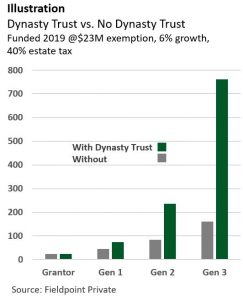

Because the dynasty trust is never eroded by any form of transfer tax, the economics of it can be profound. For example, if you funded a dynasty trust in 2019 at the full exemption (couples) of approximately $23 million, and it appreciates at 6% after-tax2 over three generations with no distributions, it would reach a value of approximately $760 million, versus under $162 million if the trust were subject to generational transfer taxes at current levels.

CONTRIBUTION AND INVESTMENT STRATEGY

Thanks to its tax protections, any contributed asset has the potential to perform well over time in a dynasty trust. However, like many wealth transfer techniques, the performance of a dynasty trust will benefit from the contribution of undervalued assets, or assets that carry an illiquidity discount, like privately held stock., or those in an LLC or LP.

As a matter of investment strategy, due to its generations-long duration, the dynasty trust is well suited to aggressive asset classes that benefit from long time horizons. Be mindful, however, that income and capital gains generated in the trust are subject to tax. This is why investments in many dynasty trusts are structured within private placement life insurance (PPLI) policies, which accumulate tax-free. The portfolios within these policies can be highly customized, and are free to invest in vehicles that would otherwise be highly taxed inefficient. This is truly wealth accumulation on steroids. (See white paper, Death Knell for the Death Tax).

DISTRIBUTION AND PROTECTIONS

The trust will typically be set up to distribute income and assets, according to its terms or in the trustee’s discretion, for one or more beneficiaries during their lifetimes. Upon their deaths, the trust will be divided into sub-trusts for the beneficiaries’ children, and so on, over time, unless and until no funds remain, or the trust terminates by it terms.

They are typically written with the same “creditor protection” features as other types of trusts. These can protect your progeny’s wealth through divorces, lawsuits, bankruptcies and other circumstances they might face.

The dynasty trust can be established with specific terms that are to be followed for the life of the trust, or to give its future trustees more flexibility to use their discretion. It also frequently includes a limited testamentary power of appointment allowing beneficiaries, by will at their death, to appoint their trust assets to persons other than the trust founder’s lineal descendants.

Illustrative purposes only. The above is not a forecast or promise of performance, but an example of the impact of a trust strategy under different interest rate scenarios.

CAUTION AHEAD

The economics, duration and terms of a dynasty trust give the grantor the power to affect dozens, even hundreds of people they will never meet. The trust can be designed to incent future behaviors, such as maintaining employment or avoiding addictions or protecting treasured family properties. They can be drafted to be administered with great consistency over time or to grant future trustees the freedom to amend terms and ultimate beneficiaries.

Altogether, the dynasty trust becomes a vessel of what is important to you, and of the wisdom you wish to pass on to the future. We explore these considerations in the white paper, The Wealth Bomb, and encourage you to explore them as you contemplate this strategy.

If you would like to learn more about the dynasty trust and other techniques that might be applicable to your circumstances, talk to your Fieldpoint Private advisor about a complimentary estate plan review.

1 Amongst the various states there is a wide range of allowable lives for these types of trusts. Many states have a 90-year limit, Florida’s is 360 years, while Delaware and South Dakota allow trusts to last “in perpetuity.”

2 While not subject to transfer tax, the assets in a dynasty trust are subject to income and capital gains tax.

Fieldpoint Private does not provide tax or legal advice.

© 2025 Fieldpoint Private Trust.